Invest

Why invest in classic cars?

This European and world market, with small series of vehicles built over a short period explains the disorder between the growing demand and the limited supply. This is the best financial investment over the last ten years, with 393% growth since 2002.

The market for the other collectibles products is lower, with stamps (+ 250% in 10 years), coins (+ 227%), art products (+193%), wine (+ 176%), jewelery (+ 156%) or watches (+ 82%). So no category has had the same evolution as classic cars, which makes it, in addition to being a passionate purchase, an excellent investment that can be fully enjoyed.

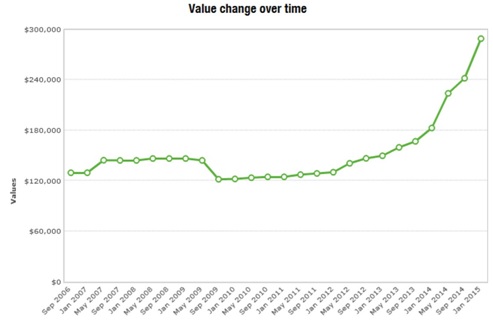

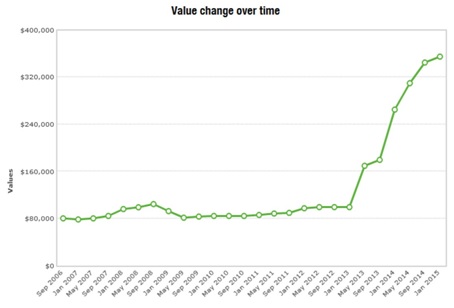

The HAGERTY index of classic cars allows precise tracking of the market evolution

HAGERTY, http://www.hagerty.com/, has developed indices to accurately track the trends of the classic car market. The HAGERTY index is made up of different vehicles representative of the market such as the Porsche 911 2.7 Carrera RS, the Mercedes-Benz 300SL or the Ferrari 275 GTB.

It is easy to see that this index has risen since 2010. Let’s take a few concrete examples:

Jaguar Type E Cabriolet 4.2 1965

Ferrari 330 GT 2+2 1967

Porsche 911 Carrera 2.7 RS

The reasons of this evolution

In times of crisis, people are more nostalgic about the past and the automobile is part of it. This explains why vintage cars represent a kind of safe haven, while associating the notion of driving pleasure, because, unlike a art products, they can be driven.

With 200,000 car events per year, including 1,300 major events and 2,000 clubs with 780,000 members, one can participate in major car events such as the Tour Auto or Le Mans Classic in France, Goodwood Revival in the United Kingdom but also the fabulous beauty contest Villa d’Este in Italy.

Autre facteur clé important, avec Internet et l’internationalisation des flux, ce marché s’est mondialisé et n’est plus réparti entre l’Europe et les Etats-Unis, créant ainsi de nombreuses importations. L’arrivée de nouveaux acteurs de Russie, Chine ou encore du Moyen-Orient participe grandement à cette hausse des prix.

The market is made up of a limited number of vehicles, so there is only one variable between supply and demand, which is the price.

Last but not least, vehicles of collection are exempt from the ISF in the same way as art products.

Please find below some interesting links:

- https://argent.boursier.com/passion/actualites/voitures-de-collection-un-placement-tres-rentable-depuis-10-ans-3538.html

- http://www.argusdelassurance.com/jurisprudences/reglementation/jurisprudence/l-eldorado-fiscal-des-voitures-de-collection.119617

- https://www.gold.fr/news/2018/01/09/investir-dans-les-voitures-de-collection-quelle-rentabilite/

- http://www.investissementporteur.com/voiture-de-collection-un-investissement-tres-rentable

- http://www.largus.fr/actualite-automobile/le-marche-de-la-voiture-de-collection-senflamme-4121379.html

- http://www.journaldunet.com/patrimoine/art-de-vivre/marche-de-la-voiture-de-collection.shtml

- http://www.lefigaro.fr/placement/2014/06/08/05006-20140608ARTFIG00003-placement-plaisir-l-automobile-de-collection.php

- http://www.challenges.fr/entreprise/20150205.CHA2832/peut-on-gagner-de-l-argent-en-investissant-dans-les-voitures-de-collection.html

Classic Car tax

Cars and motorcycles of collection are subject to the same regime as works of art, with a tax on capital gains on resale, but the value of these vehicles is not taken into account in the calculation of the ISF.

Since September 2014, a new circular provides additional information on the qualification of a classic cars, the following french excerpt:

Pour l’application de la taxe forfaitaire sur les métaux précieux, les bijoux, les objets d’art, de collection et d’antiquité prévue à l‘article 150 VI du code général des impôts (CGI), d’une part, et de l’exonération d’impôt de solidarité sur la fortune (ISF) prévue à l’article 885 I du CGI, d’autre part, les véhicules de collection s’entendent désormais de ceux qui correspondent aux critères exposés dans la circulaire douanière n° FCPD1421298C du 8 septembre 2014, publiée au bulletin officiel des douanes n° 7032.

In addition to vehicles that have participated in a historic event or have a significant record, they have to be:

• in their original condition without substantial modification of the chassis, body, steering, braking, transmission or suspension system or the engine

• at least thirty years of age

• a model or type whose production has been stopped

These provisions apply to the ISF due from the year 2015.

In order to correctly interpret this text it is therefore necessary to refer to the customs circular. Because the text doesn’t specify the cumulative or not of the 3 criteria.

For more information, please find below the links:

- http://circulaires.legifrance.gouv.fr/pdf/2014/09/cir_38712.pdf

- http://www.mon-patrimoine.fr/2015/01/13/vehicule-de-collection-et-exoneration-isf/

- http://m.legifiscal.fr/actualites-fiscales/674-isf-nouvelle-definition-fiscale-des-vehicules-de-collection.html

Tax on resale

This investment “pleasure”, allows to dispose at his convenience of an exceptional car while realizing a nice added value to its resale.

According to the article 150 VI du CGI, classic cars as well as motorcycles, are subjected to the taxation on the surplus-value:

- There are currently two choices which depend in particular on the gain realized on the car and on the duration of its holding.

• The flat-rate system if the seller does not have the documents justifying the price and the date of acquisition of his car. In this case, the flat rate tax is 6.5% of price selling .

• The common law regime applies if the seller has in his possession the documents attesting the value and the date of purchase. In this case, the surplus-value is taxed at the rate of 19% + 15.5% of social contributions regardless of the length of detention.

• After the second year, the investor benefits from a specific abatement of 5% each year. (Exemption from capital gains tax after 22 years of holding)

• For classic cars, capital gains on disposals <5000 € are not taxed.

For more information, please find below the links: